Gold (pronounced /ˈɡoʊld/) is a chemical element with the symbol Au (Latin: aurum) and atomic number 79. It is a highly sought-after precious metal, having been used as money, as a store of value, in jewelry, in sculpture, and for ornamentation since the beginning of recorded history. The metal occurs as nuggets or grains in rocks, in veins and in alluvial deposits. Gold is dense, soft, shiny and the most malleable and ductile pure metal known. Pure gold has a bright yellow color traditionally considered attractive. It is one of the coinage metals and formed the basis for the gold standard used before the collapse of the Bretton Woods system in 1971. The ISO currency code of gold bullion is XAU.

Modern industrial uses include dentistry and electronics, where gold has traditionally found use because of its good resistance to oxidative corrosion. Chemically, gold is a transition metal and can form trivalent and univalent cations upon solvation. At STP it is attacked by aqua regia, forming chloroauric acid and by alkaline solutions of cyanide but not by hydrochloric, nitric or sulphuric acids. Gold dissolves in mercury, forming amalgam alloys, but does not react with it. Gold is insoluble in nitric acid, which will dissolve silver and base metals, and is the basis of the gold refining technique known as "inquartation and parting". Nitric acid has long been used to confirm the presence of gold in items, and this is the origin of the colloquial term "acid test", referring to a gold standard test for genuine value.

Color of gold

Mainly, gold appears to be metallic yellow. Gold, caesium and copper are the only elemental metals with a natural color other than gray or white. The usual gray color of metals depends on their "electron sea" that is capable of absorbing and re-emitting photons over a wide range of frequencies. Gold reacts differently, depending on subtle relativistic effects that affect the orbitals around gold atoms.[2][3]

History

Gold has been known and highly valued since prehistoric times. It may have been the first metal used by humans and was valued for ornamentation and rituals. Egyptian hieroglyphs from as early as 2600 BC describe gold, which king Tushratta of the Mitanni claimed was "more plentiful than dirt" in Egypt.[9] Egypt and especially Nubia had the resources to make them major gold-producing areas for much of history. The earliest known map is known as the Turin papyrus and shows the plan of a gold mine in Nubia together with indications of the local geology. The primitive working methods are described by Strabo and included fire-setting. Large mines also occurred across the Red Sea in what is now Saudi Arabia.

The legend of the golden fleece may refer to the use of fleeces to trap gold dust from placer deposits in the ancient world. Gold is mentioned frequently in the Old Testament, starting with Genesis 2:11 (at Havilah) and is included with the gifts of the magi in the first chapters of Matthew New Testament. The Book of Revelation 21:21 describes the city of New Jerusalem as having streets "made of pure gold, clear as crystal". The south-east corner of the Black Sea was famed for its gold. Exploitation is said to date from the time of Midas, and this gold was important in the establishment of what is probably the world's earliest coinage in Lydia between 643 and 630 BC.

From 6th or 5th century BCE, Chu (state) circulated Ying Yuan, one kind of square gold coin.

The Romans developed new methods for extracting gold on a large scale using hydraulic mining methods, especially in Spain from 25 BC onwards and in Romania from 150 AD onwards. One of their largest mines was at Las Medulas in León (Spain), where seven long aqueducts enabled them to sluice most of a large alluvial deposit. The mines at Roşia Montană in Transylvania were also very large, and until very recently, still mined by opencast methods. They also exploited smaller deposits in Britain, such as placer and hard-rock deposits at Dolaucothi. The various methods they used are well described by Pliny the Elder in his encyclopedia Naturalis Historia written towards the end of the first century AD.

The Mali Empire in Africa was famed throughout the old world for its large amounts of gold. Mansa Musa, ruler of the empire (1312–1337) became famous throughout the old world for his great hajj to Mecca in 1324. When he passed through Cairo in July of 1324, he was reportedly accompanied by a camel train that included thousands of people and nearly a hundred camels. He gave away so much gold that it depressed the price in Egypt for over a decade.[10] A contemporary Arab historian remarked:

| “ | Gold was at a high price in Egypt until they came in that year. The mithqal did not go below 25 dirhams and was generally above, but from that time its value fell and it cheapened in price and has remained cheap till now. The mithqal does not exceed 22 dirhams or less. This has been the state of affairs for about twelve years until this day by reason of the large amount of gold which they brought into Egypt and spent there [...] | ” |

The European exploration of the Americas was fueled in no small part by reports of the gold ornaments displayed in great profusion by Native American peoples, especially in Central America, Peru, Ecuador and Colombia.

Although the price of some platinum group metals can be much higher, gold has long been considered the most desirable of precious metals, and its value has been used as the standard for many currencies (known as the gold standard) in history. Gold has been used as a symbol for purity, value, royalty, and particularly roles that combine these properties. Gold as a sign of wealth and prestige was made fun of by Thomas More in his treatise Utopia. On that imaginary island, gold is so abundant that it is used to make chains for slaves, tableware and lavatory-seats. When ambassadors from other countries arrive, dressed in ostentatious gold jewels and badges, the Utopians mistake them for menial servants, paying homage instead to the most modestly-dressed of their party.

There is an age-old tradition of biting gold in order to test its authenticity. Although this is certainly not a professional way of examining gold, the bite test should score the gold because gold is a soft metal, as indicated by its score on the Mohs' scale of mineral hardness. The purer the gold the easier it should be to mark it. Painted lead can cheat this test because lead is softer than gold (and may invite a small risk of lead poisoning if sufficient lead is absorbed by the biting).

Gold in antiquity was relatively easy to obtain geologically; however, 75% of all gold ever produced has been extracted since 1910.[12] It has been estimated that all the gold in the world that has ever been refined would form a single cube 20 m (66 ft) on a side (equivalent to 8000 m³).[12]

One main goal of the alchemists was to produce gold from other substances, such as lead — presumably by the interaction with a mythical substance called the philosopher's stone. Although they never succeeded in this attempt, the alchemists promoted an interest in what can be done with substances, and this laid a foundation for today's chemistry. Their symbol for gold was the circle with a point at its center (☉), which was also the astrological symbol, and the ancient Chinese character, for the Sun. For modern creation of artificial gold by neutron capture, see gold synthesis.

During the 19th century, gold rushes occurred whenever large gold deposits were discovered. The first documented discovery of gold in the United States was at the Reed Gold Mine near Georgeville, North Carolina in 1803.[13] The first major gold strike in the United States occurred in a small north Georgia town called Dahlonega.[14] Further gold rushes occurred in California, Colorado, Otago, Australia, Witwatersrand, Black Hills, and Klondike.

Because of its historically high value, much of the gold mined throughout history is still in circulation in one form or another.

Occurrence

In nature, gold most often occurs in its native state (that is, as a metal), though usually alloyed with silver. Native gold contains usually eight to ten percent silver, but often much more — alloys with a silver content over 20% are called electrum. As the amount of silver increases, the color becomes whiter and the specific gravity becomes lower.

Ores bearing native gold consist of grains or microscopic particles of metallic gold embedded in rock, often in association with veins of quartz or sulfide minerals like pyrite. These are called "lode" deposits. Native gold is also found in the form of free flakes, grains or larger nuggets that have been eroded from rocks and end up in alluvial deposits (called placer deposits). Such free gold is always richer at the surface of gold-bearing veins owing to the oxidation of accompanying minerals followed by weathering, and washing of the dust into streams and rivers, where it collects and can be welded by water action to form nuggets.

Gold sometimes occurs combined with tellurium as the minerals calaverite, krennerite, nagyagite, petzite and sylvanite, and as the rare bismuthide maldonite (Au2Bi) and antimonide aurostibite (AuSb2). Gold also occurs in rare alloys with copper, lead, and mercury: the minerals auricupride (Cu3Au), novodneprite (AuPb3) and weishanite ((Au,Ag)3Hg2).

Production

Economic gold extraction can be achieved from ore grades as little as 0.5 g/1000 kg (0.5 parts per million, ppm) on average in large easily mined deposits. Typical ore grades in open-pit mines are 1–5 g/1000 kg (1–5 ppm); ore grades in underground or hard rock mines are usually at least 3 g/1000 kg (3 ppm). Because ore grades of 30 g/1000 kg (30 ppm) are usually needed before gold is visible to the naked eye, in most gold mines the gold is invisible.

Since the 1880s, South Africa has been the source for a large proportion of the world’s gold supply, with about 50% of all gold ever produced having come from South Africa. Production in 1970 accounted for 79% of the world supply, producing about 1,000 tonnes. However by 2007 production was just 272 tonnes. This sharp decline was due to the increasing difficulty of extraction, changing economic factors affecting the industry, and tightened safety auditing. In 2007 China (with 276 tonnes) overtook South Africa as the world's largest gold producer, the first time since 1905 that South Africa has not been the largest.[15]

The city of Johannesburg located in South Africa was founded as a result of the Witwatersrand Gold Rush which resulted in the discovery of some of the largest gold deposits the world has ever seen. Gold fields located within the basin in the Free State and Gauteng provinces are extensive in strike and dip requiring some of the world's deepest mines, with the Savuka and TauTona mines being currently the world's deepest gold mine at 3,777 m. The Second Boer War of 1899–1901 between the British Empire and the Afrikaner Boers was at least partly over the rights of miners and possession of the gold wealth in South Africa.

Other major producers are the United States, Australia, China, Russia and Peru. Mines in South Dakota and Nevada supply two-thirds of gold used in the United States. In South America, the controversial project Pascua Lama aims at exploitation of rich fields in the high mountains of Atacama Desert, at the border between Chile and Argentina. Today about one-quarter of the world gold output is estimated to originate from artisanal or small scale mining.[16]

After initial production, gold is often subsequently refined industrially by the Wohlwill process or the Miller process. Other methods of assaying and purifying smaller amounts of gold include parting and inquartation as well as cuppelation, or refining methods based on the dissolution of gold in aqua regia.

The world's oceans hold a vast amount of gold, but in very low concentrations (perhaps 1–2 parts per 10 billion). A number of people have claimed to be able to economically recover gold from sea water, but so far they have all been either mistaken or crooks. Reverend Prescott Jernegan ran a gold-from-seawater swindle in America in the 1890s. A British fraudster ran the same scam in England in the early 1900s.[17]

Fritz Haber (the German inventor of the Haber process) attempted commercial extraction of gold from sea water in an effort to help pay Germany's reparations following World War I. Unfortunately, his assessment of the concentration of gold in sea water was unduly high, probably due to sample contamination. The effort produced little gold and cost the German government far more than the commercial value of the gold recovered.[citation needed] No commercially viable mechanism for performing gold extraction from sea water has yet been identified. Gold synthesis is not economically viable and is unlikely to become so in the foreseeable future.

The average gold mining and extraction costs[when?] are $238 per troy ounce but these can vary widely depending on mining type and ore quality. In 2001, global mine production amounted to 2,604 tonnes, or 67% of total gold demand in that year. At the end of 2006, it was estimated that all the gold ever mined totaled 158,000 tonnes.[18] This can be represented by a cube with an edge length of just 20.2 meters.

At current consumption rates, the supply of gold is believed to last 45 years.[19]

Price

Like other precious metals, gold is measured by troy weight and by grams. When it is alloyed with other metals the term carat or karat is used to indicate the amount of gold present, with 24 karats being pure gold and lower ratings proportionally less. The purity of a gold bar can also be expressed as a decimal figure ranging from 0 to 1, known as the millesimal fineness, such as 0.995 being very pure.

The price of gold is determined on the open market, but a procedure known as the Gold Fixing in London, originating in September 1919, provides a daily benchmark figure to the industry. The afternoon fixing appeared in 1968 to fix a price when US markets are open.

Historically gold coinage was widely used as currency; When paper money was introduced, it typically was a receipt redeemable for gold coin or bullion. In an economic system known as the gold standard, a certain weight of gold was given the name of a unit of currency. For a long period, the United States government set the value of the US dollar so that one troy ounce was equal to $20.67 ($664.56/kg), but in 1934 the dollar was devalued to $35.00 per troy ounce ($1125.27/kg). By 1961 it was becoming hard to maintain this price, and a pool of US and European banks agreed to manipulate the market to prevent further currency devaluation against increased gold demand.

On March 17, 1968, economic circumstances caused the collapse of the gold pool, and a two-tiered pricing scheme was established whereby gold was still used to settle international accounts at the old $35.00 per troy ounce ($1.13/g) but the price of gold on the private market was allowed to fluctuate; this two-tiered pricing system was abandoned in 1975 when the price of gold was left to find its free-market level. Central banks still hold historical gold reserves as a store of value although the level has generally been declining. The largest gold depository in the world is that of the U.S. Federal Reserve Bank in New York, which holds about 3%[citation needed] of the gold ever mined, as does the similarly-laden U.S. Bullion Depository at Fort Knox.

In 2005 the World Gold Council estimated total global gold supply to be 3,859 tonnes and demand to be 3,754 tonnes, giving a surplus of 105 tonnes.[20]

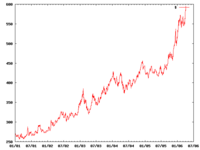

Price records

Since 1968 the price of gold on the open market has ranged widely, from a high of $850/oz ($27,300/kg) on January 21, 1980, to a low of $252.90/oz ($8,131/kg) on June 21, 1999 (London Gold Fixing).[21] The 1980 high was not overtaken until January 3, 2008 when a new maximum of $865.35 per troy ounce was set (a.m. London Gold Fixing).[22] The current record price was set on March 17, 2008 at $1023.50/oz (am. London Gold Fixing).[22]

Long term price trends

Since April 2001 the gold price has more than tripled in value against the US dollar,[23] prompting speculation that this long secular bear market (or the Great Commodities Depression) has ended and a bull market has returned.[24] In March 2008, the gold price increased above $1000,[25] which in real terms is still well below the $850/oz. peak on January 21, 1980. Indexed for inflation, the 1980 high would equate to a price of around $2400 in 2007 US dollars.

In the last century, major economic crises (such as the Great Depression, World War II, the first and second oil crisis) lowered the Dow/Gold ratio (which is inherently inflation adjusted) substantially, in most cases to a value well below 4.[26] During these difficult times, investors tried to preserve their assets by investing in precious metals, most notably gold and silver.

Compounds

Although gold is a noble metal, it forms many and diverse compounds. The oxidation state of gold in its compound ranges from −1 to +5 but Au(I) and Au(III) dominate. Gold(I), referred to as the aurous ion, is the most common oxidation state with “soft” ligands such as thioethers, thiolates, and tertiary phosphines. Au(I) compounds are typically linear. A good example is Au(CN)2−, which is the soluble form of gold encountered in mining. Curiously, aurous complexes of water are rare. The binary gold halides, such as AuCl, form zig-zag polymeric chains, again featuring linear coordination at Au. Most drugs based on gold are Au(I) derivatives.[27]

Gold(III) (“auric”) is a common oxidation state and is illustrated by gold(III) chloride, AuCl3. Its derivative is chloroauric acid, HAuCl4, which forms when Au dissolves in aqua regia. Au(III) complexes, like other d8 compounds, are typically square planar.

Less common oxidation states: Au(-I), Au(II), and Au(V)

Compounds containing the Au− anion are called aurides. Caesium auride, CsAu which crystallizes in the caesium chloride motif.[28] Other aurides include those of Rb+, K+, and tetramethylammonium (CH3)4N+.[29] Gold(II) compounds are usually diamagnetic with Au-Au bonds such as [Au(CH2)2P(C6H5)2]2Cl2. A noteworthy, legitimate Au(II) complex contains xenon as a ligand, [AuXe4](Sb2F11)2.[30] Gold pentafluoride is the sole example of Au(V), the highest verified oxidation state.[31]

Some gold compounds exhibit aurophilic bonding, which describes the tendency of gold ions to interact at distances that are too long to be a conventional Au-Au bond but shorter that van der Waals bonding. The interaction is estimated to be comparable in strength to that of a hydrogen bond.

Mixed valence compounds

Well-defined cluster compounds are numerous.[29] In such cases, gold has a fractional oxidation state. A representative example is the octahedral species {Au(P(C6H5)3)}62+. Gold chalcogenides, e.g. "AuS" feature equal amounts of Au(I) and Au(III).

Isotopes

Gold has only one stable isotope, 197Au, which is also its only naturally-occurring isotope. 36 radioisotopes have been synthesized ranging in atomic mass from 169 to 205. The most stable of these is 195Au with a half-life of 186.1 days. 195Au is also the only isotope to decay by electron capture. The least stable is 171Au, which decays by proton emission with a half-life of 30 µs. Most of gold's radioisotopes with atomic masses below 197 decay by some combination of proton emission, α decay, and β+ decay. The exceptions are 195Au, which decays by electron capture, and 196Au, which has a minor β- decay path. All of gold's radioisotopes with atomic masses above 197 decay by β- decay.[32]

At least 32 nuclear isomers have also been characterized, ranging in atomic mass from 170 to 200. Within that range, only 178Au, 180Au, 181Au, 182Au, and 188Au do not have isomers. Gold's most stable isomer is 198m2Au with a half-life of 2.27 days. Gold's least stable isomer is 177m2Au with a half-life of only 7 ns. 184m1Au has three decay paths: β+ decay, isomeric transition, and alpha decay. No other isomer or isotope of gold has three decay paths.[32]

Symbolism

Gold has been associated with the extremities of utmost evil and great sanctity throughout history. In the Book of Exodus, the Golden Calf is a symbol of idolatry and rebellion against God. In popular culture, the golden pocket watch and its fastening golden chain were the characteristic accessories of the capitalists, the rich and the industrial tycoons. Credit card companies associate their product with wealth by naming and coloring their top-of-the-range cards “gold” although, in an attempt to out-do each other, platinum has now overtaken gold.

In the Book of Genesis, Abraham was said to be rich in gold and silver, and Moses was instructed to cover the Mercy Seat of the Ark of the Covenant with pure gold. Eminent orators such as John Chrysostom were said to have a “mouth of gold with a silver tongue.” Gold is associated with notable anniversaries, particularly in a 50-year cycle, such as a golden wedding anniversary, golden jubilee, etc.

Great human achievements are frequently rewarded with gold, in the form of medals and decorations. Winners of races and prizes are usually awarded the gold medal (such as the Olympic Games and the Nobel Prize), while many award statues are depicted in gold (such as the Academy Awards, the Golden Globe Awards the Emmy Awards, the Palme d'Or, and the British Academy Film Awards).

Medieval kings were inaugurated under the signs of sacred oil and a golden crown, the latter symbolizing the eternal shining light of heaven and thus a Christian king's divinely inspired authority. Wedding rings are traditionally made of gold; since it is long-lasting and unaffected by the passage of time, it is considered a suitable material for everyday wear as well as a metaphor for the relationship. In Orthodox Christianity, the wedded couple is adorned with a golden crown during the ceremony, an amalgamation of symbolic rites.

The symbolic value of gold varies greatly around the world, even within geographic regions[where?].

Toxicity

Pure gold is non-toxic and non-irritating when ingested[33] and is sometimes used as a food decoration in the form of gold leaf. It is also a component of the alcoholic drinks Goldschläger, Gold Strike, and Goldwasser. Gold is approved as a food additive in the EU (E175 in the Codex Alimentarius).

Soluble compounds (gold salts) such as potassium gold cyanide, used in gold electroplating, are toxic to the liver and kidneys. There are rare cases of lethal gold poisoning from potassium gold cyanide.[34][35] Gold toxicity can be ameliorated with chelating agents such as British anti-Lewisite.

GOLDPRICE.ORG provides you with fast loading charts of the current gold price per ounce, gram and kilogram in 23 major currencies. We provide you with timely and accurate silver and gold price commentary, gold price history charts for the past 30 days, 60 days, 1, 5, 10 and 30 years and gold futures quotes and charts. You can also find out where to buy gold coins from gold dealers at the best gold prices or compare eBay gold prices and eBay silver prices.

NEW! - Live Gold Price Charts

NEW! - Live Gold Price Charts

- Real time and historical prices.

- Live Spot Gold and Spot Silver in Euro, Yen, AUD, CAD, GBP and CHF.

- Spot Platinum and Spot Palladium.

- US Dollar Index.

- Oil Price.

- All Major Currency Exchange Rates.

Gold Traders Assn: Weakening baht drives gold prices up to new highs Last Change %Change High Low Volume Value SET Index 438.22 -8.42 -1.89 444.22 436.68 2,498,515 8,431.78 SET100 Index 645.52 -14.75 -2.23 655.90 643.02 711,865 6,539.88 SET50 Index 303.46 -7.12 -2.29 308.40 302.21 381,029 5,969.15 FSTHL 505.14 -13.01 -2.51 - - - - mai Index 166.66 -0.61 -0.36 168.25 166.31 39,564 94.24 Investor Type Buy % Sell % Net Local Institutions 1,178.31 13.82% 1,780.47 20.88% -602.16 M Foreign Institutions 1,879.91 22.05% 2,874.67 33.72% -994.76 M Retail Investors 5,467.80 64.13% 3,870.88 45.40% 1,596.92 M

Thailand’s gold prices have just traded up to the highest level ever because the value of the baht still fell continuously against the U.S. dollar.

Gold Traders Association President, Jitti Tangsithpakdi, says local gold prices have shot up to historic highs on Tuesday.

At present, gold ornament costs 16,050 baht per 15.16 grams while bullion is 15,650 baht.

Gold trade in Thailand has been in a volatile session since the opening bell.

And while local prices hit new highs, the world gold price is now at 950 dollars an ounce which is still lower than the 1,000-dollars-an-ounce level recorded last year.

Jitti says the continued depreciation of the baht is to be blamed for the gold price surge.

He expects domestic prices to continue fluctuating in the near term with a possibility that bullion price will hit the 16,000-baht level soon.

Despite this, Jitti reckons that the present price surge will not make the public rush to take profits on their holdings like in the past months as a lot of people should have run low on their gold stock already.

In any case, the Gold Traders Association states he will be keeping a close eye on the world gold trade during the next few days especially after the U.S. market took a day off on Monday.

*******************************************************

GM Thailand offers early retirement program; plans executive pay cut

The subsidiary unit of the largest U.S automaker is forced to implement a new cost-cutting program to help it cope with plunging orders due to the present economic crisis.

General Motors (Thailand) announced on Tuesday, it is implementing a restructuring plan to help it survive the present economic downturn which recently led to a heavy drop in consumer demand.

Under this plan, the early retirement program will be offered to all its employees who can be re-hired once the situation returns to normal.

The company also promised participating employees all benefits that will be even higher than the laws have stipulated.

However, it concedes that if the program is a failure, GM Thailand will have to seek other measures to achieve the restructuring plan.

In addition, the company notes that a production halt is not an effective approach to help cut costs as each worker will continue to receive half of the paycheck while it will be never be sure when the economy will improve.

Previously, General Motors already announced a move to cut 10,000 jobs worldwide. Now it is also launching a temporary 10-% pay reduction for all executives as well as considering benefit adjustment in all countries.

*******************************************************

Commerce Min: Exports likely to contract from Jan through Jun 2009

The commerce minister is conceding the country’s exports could suffer 6 months of contraction this year.

Commerce Minister, Pornthiva Nakasai, is worried Thai exports could contract significantly in January and such a trend might continue throughout the first half of this year.

While denying to confirm if the latest growth rate was minus 25% as many have speculated, Pornthiva pledges to introduce more stimulus measures to help lessen the contraction as much as possible.

The Commerce Ministry is expected to release its official trade report later this week.

The commerce minister also hopes that the country’s money-spinner will register a growth rate after the middle of 2009 after all countries have heavily injected cash into their financial systems.

She went on to say that the ministry still keeps the 2009 export growth target at 0-3%.

Meanwhile, Commerce Ministry Permanent Secretary, Siripol Yodmuangcharoen, says the industry groups that will highly likely suffer serious contraction include electronic circuit, electrical appliance, auto and parts.

*******************************************************

Experts urge local operators to make quick improvement while crisis continues

Experts are warning local business operators to turn the current crisis into an opportunity to improve their efficiency and competitiveness before the economic conditions pick up hopefully from Q2-09.

Federation of Thai Industries Vice President, Niphon Surapongrukcharoen, says he hopes the export sector will make a significant recovery after Q1-09.

Niphon is still hopeful that the situation will become more favorable soon even though international trade is still in a slump or even contracts in some countries.

He suggests all business operators to quickly adjust themselves to cope with the fast-changing environment.

He also notes that while purchase orders from overseas shrink local entrepreneurs should focus on improving their competitiveness and their products to meet international standards.

Meanwhile, SCIB Securities Assistant Managing Director, Sukit Udomsirikul, comments that manufacturing companies whose 30 % of their output is for exports are at high risk from the present economic turmoil.

He suggests those experiencing the hardship to use their excess capacity for other substitute industries such as agriculture, foods and services.

And deputy dean of NIDA Business School, Narumol Sa-atchome, says Thailand is to keep a close eye on the possibility of new trade barriers implemented by many countries and the present financial woes which could still hurt the country’s economy more than expected.

*******************************************************

Finance Ministry plans to raise sin tax on 21 selected products & services

The Finance Ministry is poised to raise the country’s sin tax on a number of products and services while moving on with its tax evasion probe against night entertainment businesses.

Deputy Finance Minister, Pruektichai Damrongrat, reveals today the Finance Ministry is in the process of tax overhaul for the country.

The ministry’s focus is particularly on sin tax.

Pruektichai says the country still has more room to raise excise taxes on 21 products and services including alcohol, cigarette, massage parlors or even carbonated drinks.

However, he concedes that the tax restructuring plan must be carefully implemented to reflect the present economic conditions without adding more burden on business operators’ shoulders.

The deputy finance minister also states that following public outcry over tax evasion by entertainment business operators a specially-appointed committee has inspected 140 entertainment venues during their operating hours of 9 p.m. to 2 a.m.

He says most places have registered themselves as restaurants to avoid paying excise taxes.

Now the ministry is awaiting the final probe result before deciding on the proper legal action against those found guilty.

SET MONITOR:

Thailand’s main stock market finished lower in line with overseas markets following heavy sell-out in the afternoon.

The Stock Exchange of Thailand composite index fell 8.4 points to 438.2 with moderately-low volume of 8.4 billion baht or about 239 million dollars.

Foreign investors were the biggest net sellers of 995.9 million baht or some 28 million dollars followed by local institutions of 602 million baht which is around 17 million dollar.

And retail investors’ net buy for today was nearly 1.6 billion baht. That’s some 45 million dollars.

The SET index ended almost 2% lower and neared its two-week low while regional markets lost 1-4% today.

Worries over the global economic downturn and slow recovery in the financial sector pressured investors to unload their holdings to prevent risks.

Index Performance

('000 Shares)

(M.Baht) Source: The Stock Exchange of Thailand.

Net Buy/Sell

(M.Baht)

(M.Baht)

(M.Baht) Source: KGI Securities (Thailand) PLC.

SET SPOTLIGHT:

DELTA holds US$200 mil in cash, ready for new investment opportunities in 2009

SET-listed Delta Electronics (Thailand) plans to spend 200 million dollars in cash to explore new investment opportunities this year.

Delta Director, Anusorn Muttaraid, believes there remain a number of profitable and diversified investments available out there while the present economic crisis continues.

Meanwhile, the company expects its 2009 sales to be similar to last year’s 32 billion baht or almost one billion dollars because of shrinking demand from the U.S.

Still it already started new investments in many counties in African and the Middle East to make up for lost revenue.

It projected this year’s gross profit margin at 24% just like in 2008.

At the closing bell, DELTA price ends 1.50% higher at 10.70 baht.

![[From www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)